WealthMapp app for iPhone and iPad

Developer: Final Mile Consulting LLC

First release : 28 Sep 2017

App size: 13.13 Mb

WealthMapp is the perfect Do-It-Yourself (DIY) tool to manage and achieve your financial goals.

Intuitive-Rationale is our innovative approach to Personal Wealth Management and the basic thinking behind this revolutionary App. It operates from the insight that people, at large, are less trusting of others when it comes to investing their wealth (professional advisors have their own motives, while family and friends have their own biases based on their experiences). So, it takes care of your inertia to act when it comes to planning your wealth journey. After all, as youll agree, time lost is money lost.

The App achieves this feat by engaging you in unique simulators and games to understand your specific goals and risk preferences towards each of those goals. Once you do that, the App understands the intuitive nature of your goal-setting process and proposes a rational approach to realise them.

HOW

The tool has a set of modules that allow people to:

- Set financial goal

- Assess risk preferences for each goal through a simulator gameplay

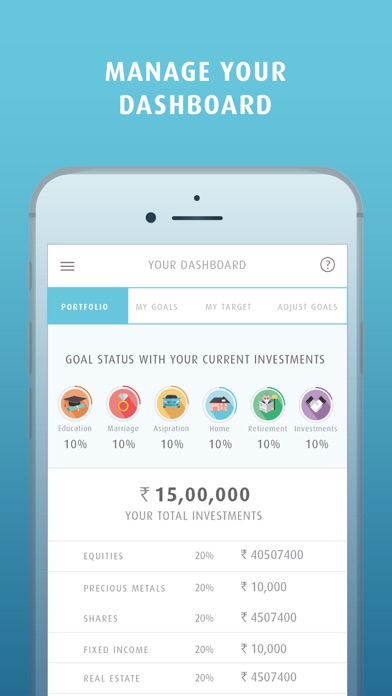

- Feed their current wealth information

- Create goals dashboards to monitor progress

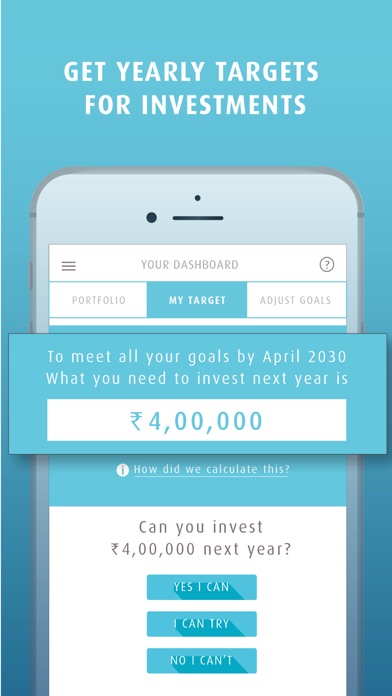

- Assess their annual money requirement for achieving the goals

- Use what-if tool kit to adjust their goals to make them achievable and

- Seek advises as and when they have surplus money to invest.

WHY

Again, while some goals are worthy of risk, others need to be managed conservatively, because each goal has its own importance and implications for you. Even if the objective is to achieve financial goals, the goals themselves are very vaguely defined in people’s minds.

This behavioral sciences-based wealth management tool overcomes these biases and deficiencies in goal planning and achievement. It uses simple game-based simulators to assess risk preferences and make their goals realistic.

It works with each persons individual preferences rather than expert’s opinion on how one should manage one’s wealth to achieve their goals. While at the same time providing them a mirror for assessing the possibilities.